nevada estate tax return

Our main office is located at 500 S. The decedent and their estate are separate taxable entities.

2022 Filing Taxes Guide Everything You Need To Know

If you have any questions about state taxes you can contact the Nevada Department of Taxation at 866-962-3707.

. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. However if the gross revenue of your corporation exceeds 4000000 during the taxable year in the future you will be required to file a Commerce tax return for your business for that taxable year. As of the 2021 tax year eight states have no income tax.

Federal State Contact Information. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF.

IRS Form 1041 US. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury. Nevada also does not have a local estate tax.

So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that she wont have a problem at the federal level. Grand Central Parkway 2nd Floor Las Vegas Nevada 89155. If you have any questions about federal taxes you can contact the IRS at 800-829-4933.

Well work closely with your tax advisor and attorney to prepare your investment plan. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ad Ask Verified Tax Pros Anything Anytime 247365.

Re-open the form from your saved location with Adobe Reader or. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience. 2011 in respect to a decedents taxable estate.

Contact our law office at 262-237-8668. Nevada currently does not have an estate tax. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser.

An estates tax ID number is called an employer identification. Will and making sure that the clients final tax returns income estate and gift arewhich vacancies. Nevadas Premier Professional Association.

100s of Top Rated Local Professionals Waiting to Help You Today. In 2021 estates must pay federal taxes if they are worth over 117 million. 31 rows Florence KY 41042-2915.

For further information on Lodging Tax Authorities please contact our Department at 775 684-2000. Since 1947 Nevada Society of Certified Public Accountants NVCPA has worked to enhance the practice of accounting in Nevada through member services support and advocacy. Starting 2018-2019 tax year a Commerce Tax filing requirement for those with Nevada gross revenue of 4000000 or less has been eliminated.

8192005 31444 PM. Our Kenosha tax lawyer assists fiduciaries with filing income tax returns for an estate or trust and paying taxes. If you have questions regarding the declaration or the online filing process please call us at 702 455-4997.

A qualified CPA or legal professional can help you. Select the available appropriate format by clicking on the icon and following the on screen instructions. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

NRS 375A025 Federal credit defined. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates.

Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county.

Nevada has no personal income tax code. State Estate Tax Return. Any specific questions regarding exemptions and rates should be addressed to the citycounty where the hotel is located.

Their hours are 7am to 7pm Monday through Friday Pacific Time. New Hampshire taxes unearned income such as interest and dividends but it will end the practice as of Jan. Meaning a homeowner wont ever see an increase in property tax of more than three percent.

Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and save to your computer. Added to NRS by 1987 2100 NRS 375A030 Gross estate defined. Department of the Treasury.

Forty-one states and Washington DC do have a state income tax. Federal credit means the maximum amount of the credit against the federal estate tax for state death taxes allowed by 26 USC. 4810 for Form 709 gift tax only.

If you do not receive a postcard by July 15 please call us at 702 455-4997. Surgents Successfully Completing an Estate Tax Return -- Form 706.

Irs Tax Penalties Tax Lawyer Tax Attorney Family Law Attorney

Business Activity Code For Taxes Fundsnet

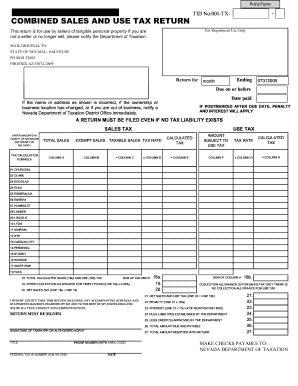

Worksheet For Completing The Sales And Use Tax Return Form 01 117

3 11 3 Individual Income Tax Returns Internal Revenue Service

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Tax Form Templates 5 Free Examples Fill Customize Download

Tax Form Templates 5 Free Examples Fill Customize Download

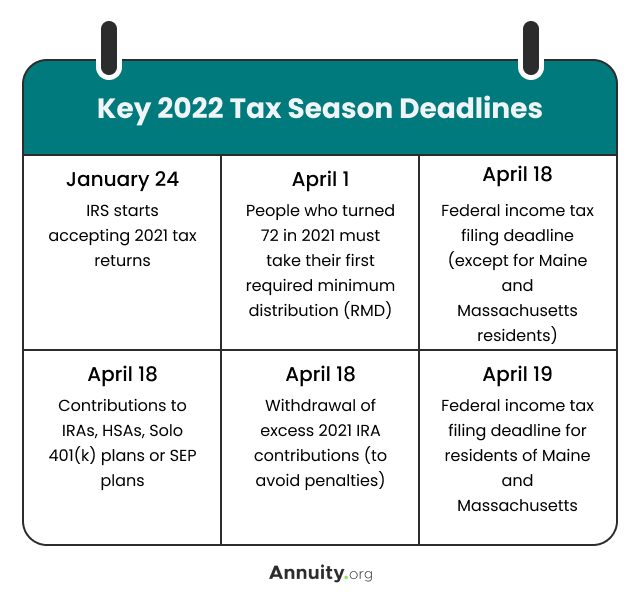

Between Due Dates For Extension Requests Ira Or Hsa Contributions And Other Deadlines There S More To Do By M Tax Deadline Estimated Tax Payments Tax Return

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

How To File Taxes For Free In 2022 Money

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

3 11 3 Individual Income Tax Returns Internal Revenue Service

Do You Have To Report 401k On Tax Return It Depends

Consumer Use Tax Nevada Fill Out And Sign Printable Pdf Template Signnow

Understanding The 1065 Form Scalefactor

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)